Confirmation Bias

So after discussing the recency bias, we will cover confirmation bias in this blog.

What is Confirmation Bias?

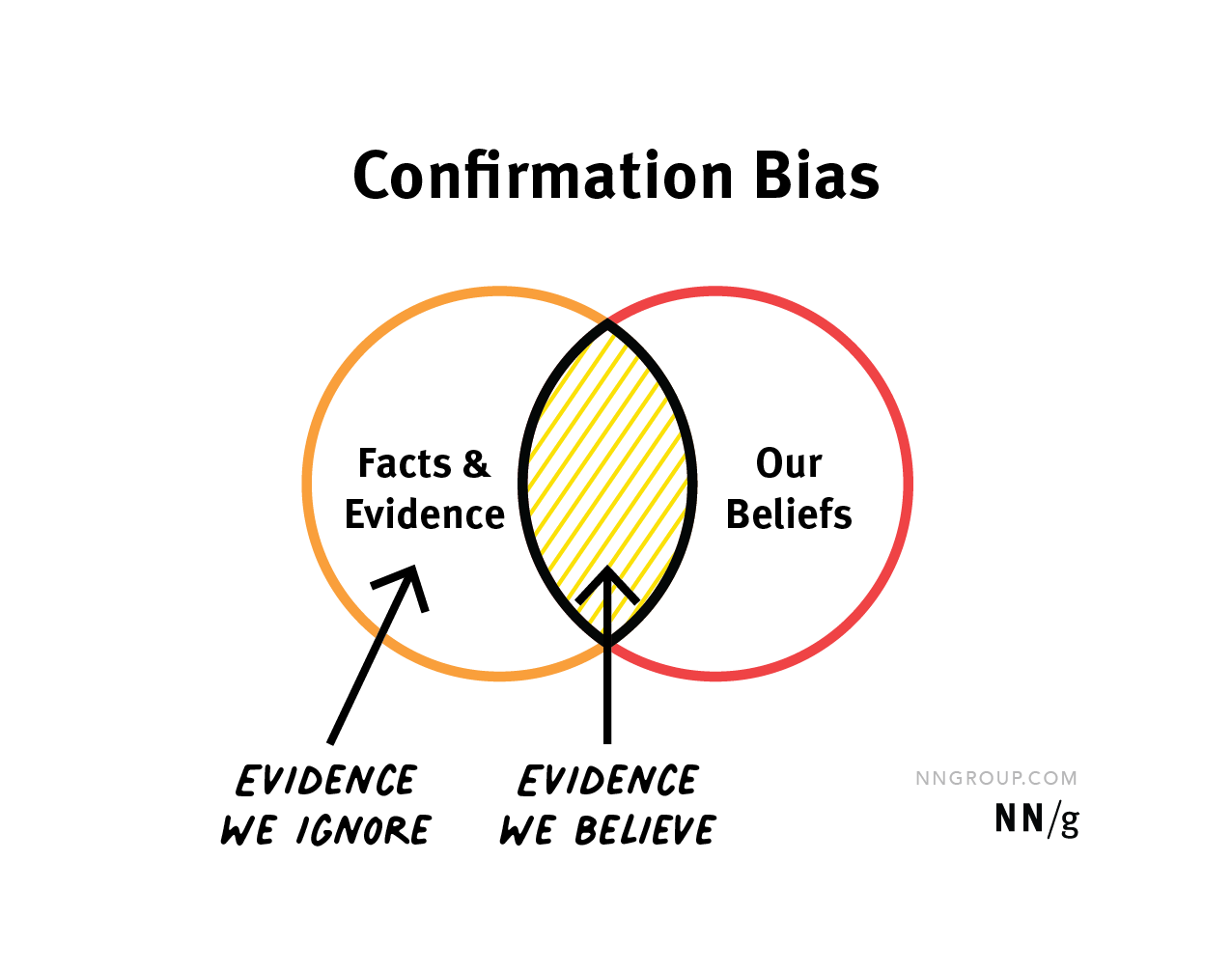

Confirmation bias is the tendency to search for, interpret, favour, and recall information in a way that confirms or supports one's prior beliefs or values.

This is a Cognitive type of bias which is related to information processing errors.

As per the definition, the obvious thing is we always look only at the facts that confirm our belief. And simply ignore the contradicting facts.

I have often fallen prey to CB and have covered this in my previous blogs. But to narrate in short.

I came across a rubber recycling company. For me, the confirmation bias points were - It's a micro-cap ( potentially a multi-bagger), 75% Promoters holding ( low float), ESG compliant, and FIIs have started buying. But the basic point that I missed was - it was in the commodity industry. So it's essential to time the cycles to reap the benefits. Here is the link for the story.

So what causes this Confirmation Bias in investing?

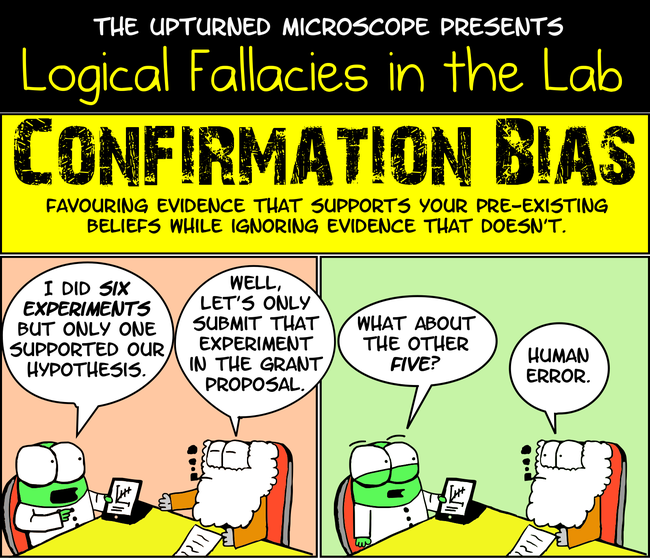

Many times we invest in a stock simply because it's a recent SM Buzz. If the stock is bought on borrowed conviction and if it's outside your circle of competence, you start looking for some PROOF to justify your investment. And here you fall prey to CB. When you search Google / Youtube / other social media sites, you only try to find out the facts that are supporting your investment thesis and subconsciously neglect the opposing points. And the fun part is Social Media also due to the algorithm, shows the confirming data only. For Example, if you search for investing, the next suggested videos will also be on investing. And same will apply to Trading.

Here is one example of how this CB can trick you.

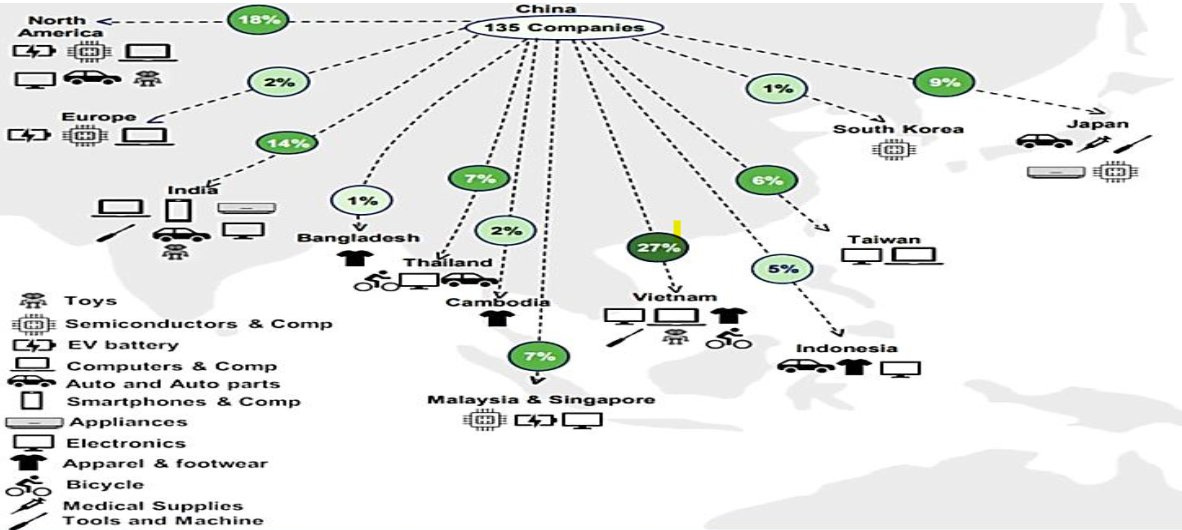

- After the COVID pandemic it was said that manufacturing from China by Western countries will shift to India. The China +1 story. Maybe it is APIs / Chemicals or Machine Manufacturing.

But below in the snippet from Bernstein Report

It clearly shows that Vietnam is the biggest beneficiary of companies moving out of China followed by the US & India. So India is the third on the list and not the first one. So we have to look objectively at all the data and then take a decision.

In the same way, Defence, Electric Vehicles & Railways - these themes are the social media buzz nowadays. But one should not fall prey to the Narratives & one must check the Numbers before investing in these companies.

Also, Confirmation Bias can itself lead to other biases like Authority Bias - You blindly follow a person who confers with your beliefs. It's very natural for humans to get along with like-minded people. It's pretty useful in social life but can be harmful in investing.

Confirmation Bias + Loss aversion can lead to Sunk cost Fallacy as we may keep on averaging down our loss-making stock.

One more important point I want to highlight is - Don't confuse Confirmation Bias with Connecting the Dots…….

When we come across 2 /3 such confirming stories related to our investment, we start thinking that we are actually CONNECTING THE DOTS.

So solutions?

As the above quote says, we have to look at the evidence objectively.

Basically, try to search for the NUMBERS than the NARRATIVE.

The more I am writing about these biases, the more it's becoming OBVIOUS that the solutions are nearly the same for all these Investing biases.

1 - Avoid Social Media Noise.

2 - Apply some checklist before buying the stock.

3 - Write and keep on reading your own Investment Diary.

Well. Very Simple but not easy.

Hope you liked this blog. Please like, subscribe and share for wider reach.

I will cover Authority Bias in the next blog.

Regards,

dr.vikas